FAIR Risk Quantification: Turning Cybersecurity Risks into Business Insights

Cybercrime is expected to cost the world $10.5 trillion annually by 2025 (Source: Business Standard). Yet, many businesses still struggle to quantify their cyber risks in financial terms. Traditional risk assessments rely on subjective ratings, making it hard to justify security investments. This is where Fair™ Risk Quantification comes into play. Risk quantification using FAIR™ (Factor Analysis of Information Risk) offers a methodical, data driven way to comprehend cyber risk in monetary terms. Organizations can make well-informed decisions and align cybersecurity with broader business goals by substituting actionable insights for inaccurate risk descriptions.

What is FAIR™ Risk Quantification?

FAIR™ (Factor Analysis of Information Risk) is a leading framework for cyber risk quantification software. Unlike traditional models that classify risks into generic categories like high, medium, or low, FAIR™ provides measurable financial insights into cyber risk exposure.

It breaks down risk into key components:

Threat Event Frequency (TEF): How often a threat is likely to occur.

Vulnerability & Resistance Strength: The likelihood of an attack successfully breaching security.

Loss Magnitude: The financial impact of a security incident.

Applying these factors allows businesses to quantify potential financial losses and make data driven decisions about cyber risk mitigation.

Why FAIR™ Risk Quantification is Essential for Risk-Aware Organizations

Align Cybersecurity with Business Strategy

Revenue, brand reputation and business continuity are all directly impacted by cyber risks. By allowing security teams to translate technical risks into business risks, FAIR elevates cybersecurity from an IT issue to a strategic role.

Justify Cybersecurity Investments

Getting funding for cybersecurity can be difficult. It is simpler to defend security expenditures using return on investment (ROI) when potential risks are given monetary values by FAIR™.

Improve Risk Communication

Executives and board members are frequently unimpressed by traditional risk reports. In order to guarantee that stakeholders are aware of the full extent of cyber risks, FAIR™ offers transparent, financially based risk assessments.

Enhance Regulatory Compliance

Strict cybersecurity regulations apply to many industries. In order to help businesses align their security programs with compliance frameworks like NIST, ISO, and CIS offer quantifiable risk assessments.

Strengthen Third-Party Risk Management

Businesses are depending more and more on outside vendors. This raises the risk of cyberattacks. By allowing companies to evaluate and measure third-party risk exposure, FAIR™ guarantees that suppliers fulfill security requirements.

How FAIR™ Risk Quantification Turns Risks into Business Insights

FAIR™ risk quantification allows organizations to shift from guessing cyber risks to making data-driven decisions. Here’s how:

1. Identify and Assess Risks

Organizations analyze industry data to determine the most relevant threats and vulnerabilities.

2. Quantify Financial Impact

Cyber risks are evaluated in terms of potential monetary loss, enabling leadership to understand their true business impact.

3. Prioritize Risk Mitigation Strategies

Businesses can focus on the most financially significant threats.

4. Measure ROI on Security Investments

FAIR™ allows organizations to compare different risk mitigation strategies and select the most cost-effective solutions.

5. Track and Adjust Over Time

Cyber risk is constantly evolving. FAIR™ enables continuous monitoring and adjustments based on emerging threats and business priorities.

Key Benefits of FAIR™ Risk Quantification

• Objective, Data-Driven Risk Decisions – Eliminate subjective risk ratings.

• Improved Budget Allocation – Direct funds to the most critical areas.

• Better Board & Executive Reporting – Present cyber risk in financial terms.

• Regulatory Compliance – Supports frameworks like NIST, ISO and CIS.

• Competitive Benchmarking – Compare your cyber risk maturity against industry peers.

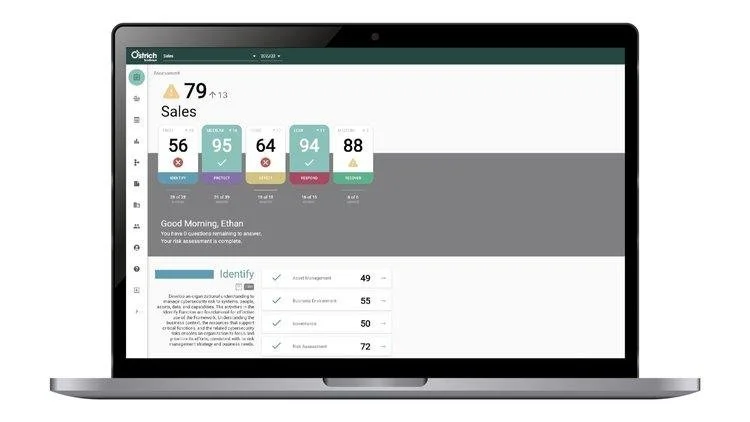

Implementing FAIR™ Risk Quantification with Birdseye™

Implementing FAIR™ risk quantification can be complex, but with the right cyber risk management tool, organizations can simplify and enhance their approach. Birdseye™ by Ostrich Cyber-Risk is a powerful cyber risk assessment platform that enables businesses to apply FAIR™ principles efficiently.

How Birdseye™ Helps Organizations:

• Assess cybersecurity risks using industry benchmarks.

• Quantify risk financially using the FAIR™ model.

• Map risks to security controls based on NIST CSF, ISO, and other frameworks.

• Simulate risk scenarios and measure potential financial impact.

• Generate executive-level reports that clearly communicate risk insights.

With the Birdseye™ CRQ Simulator, businesses can run unlimited risk simulations and compare different mitigation strategies to find the most effective solution.

Book a Demo today to see how Birdseye™ can transform your cyber risk management strategy.

Conclusion

FAIR™ risk quantification offers a unique approach for businesses looking to move beyond guesswork and make informed cybersecurity decisions. Leveraging a robust cyber risk quantification software like Birdseye™ allows organizations to assess, quantify, and manage risks effectively in financial terms. Cyber risk management is no longer about reacting to threats; it is about proactive, strategic planning.

Ready to take control of your cyber risk? Book a Demo with Birdseye™ today!

FAQs

1. How does FAIR risk quantification vary from traditional risk assessments?

FAIR risk quantification assigns financial value to cyber risks, whereas traditional assessments rely on subjective ratings like high, medium, or low.

2. Is FAIR risk quantification suitable for all industries?

Yes! FAIR applies to organizations of all sizes and industries, including financial services, healthcare, and cyber risk management for legal firms.

3. How does Birdseye™ enhance FAIR risk quantification?

Birdseye™ simplifies the process with automation, real-time industry benchmarks, and executive-level reporting, making cyber risk quantification more accessible and actionable.